If the USA didn’t have such a complicated tax system, with companies like Intuit lobbying to keep it that way so they still make money, this wouldn’t be an issue.

A lot of countries automatically fill out your entire income tax return for you, and send it to you to verify it. If it’s all good, you just need to accept it. Less than five minutes work.

If the USA didn’t have such a complicated tax system

For 95% of the public, its not complicated. Its just getting all the independent pieces of information from different private agencies.

- W2 from employer

- 1098 from your mortgage company

- 1099 from your retirement account firm

- Prove you have health insurance

- Prove you have student debts

- Prove you have a small business and you’ve tracked your receipts

- Prove you have children

- Prove you paid taxes to your state

Once you have all the numbers lined up, its simple arithmetic. Easy for a computer to do.

But knowing who to ask for all the individual chunks of data is an obnoxious chore that only one organization does particularly well. And that organization - the IRS - won’t tell you the information they have. They want you to guess and tell them what you have, so they can tell you if you got it right or not.

And that organization - the IRS - won’t tell you the information they have. They want you to guess and tell them what you have, so they can tell you if you got it right or not.

This really needs to be fixed.

In Australia, the stuff the government knows about you gets prefilled in the tax return form. Not as good as other countries where the entire thing is completed for you, but better than the USA. The form is significantly shorter than the US one.

but better than the USA

When the bar is “You get nothing. Zero. Goose-egg.” its fairly easy to clear.

The form is significantly shorter than the US one.

A big part of the US tax game is giving you a relatively high base rate and then sending you hunting for deductions and credits. One of the upshots of the Trump Tax Cut has been to raise the standard deduction so high that most of those deductions and credits are worthless. So the form is deceptively long. It’s almost impossible to use your Schedule A for anything anymore.

Just reading that gave me a headache. In Latvia, heres how the system works.

If you have no deductible spending (medical, education, donations).:

- Log into the govt system.

- Press a button to generate tax form.

- Press verify and submit.

- Pay what you owe or wait for the tax return.

If you have deductible info

- As before but also scan your receipts, and add the info on each receipt to the form. Can done easily via an app, which handily (sometimes correctly) can autofill the needed info. You can do this at any point in time, so you can do it whenever you get a deductible receipt.

- As before but also scan your receipts, and add the info on each receipt to the form. Can done easily via an app, which handily (sometimes correctly) can autofill the needed info. You can do this at any point in time, so you can do it whenever you get a deductible receipt.

I’m so envious!

they will definitely tell you, just go online and download your tax transcript – it contains all reported information.

Its not quite that simple, because you need to know what a “tax transcript” is and also set yourself up with a new kind of ID that I’d never heard of before today.

https://www.irs.gov/individuals/get-transcript

Not exactly front-facing on the website, which is itself not exactly easy to navigate.

I don’t understand why generative AI would be involved in a tax return? It’s just data entry.

If your tax return needs creative assistance, maybe you should go to jail instead?

I think the point of this comic is that AI is doing all of the fun creative stuff for us but the jobs that we actually hate doing are beyond its capabilities.

Using AI for tax calculations is one of the most insane and braindead ideas i have ever seen. Only topped by military, medical and surveillance applications.

Dont let anything AI near your money people.

Lol you think Turbo Tax or your bank isn’t using AI for all that?

Your bank is using AI for what really matters to it - figuring out how to sell you shit you don’t need.

Boring solved problems, like encoding tax laws, or paying for a taco, tend not to use AI today, and aren’t very likely to have it added, until it’s hallucinations have gone way down.

Swear to God people don’t understand how software works at all. It’s like you said: solved problems don’t need AI. I wish more people understood this. AI is insanely inefficient and power-hungry. Are there applications where it works and is the best tool for the job? Maybe? I don’t know. The closest I’ve seen is in cases where you basically want to throw a bunch of random shit at the wall and see what sticks, and there’s no real way to automate that properly.

But solved problems have solutions that are faster (like, orders of magnitude faster in most cases) and don’t consume anywhere near as much power than AI. And people clearly don’t understand how software works, because “power consumption” is a massive factor in how much you pay for cloud services (which is what most AI companies are doing).

So… the irs knows how much you’re paying before you ever file.

They could just send you a bill.

I agree with you but it’s also a sorta. They don’t know if you’ve done any under the table work that you need to report. With that said, they definitely could just have you log in securely with all your info already inputed and just have you double check and sign with the option to add more if needed. That’s how the Australians do it iirc, just log in, check and sign.

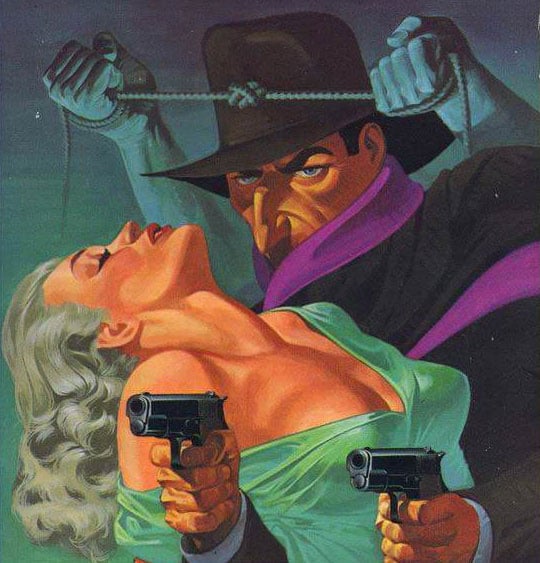

Is nobody going to call out the stilted weirdness that is the first panel??

“I can artwork that for you” is gibberish.

It’s better than the text you see in ai generated images