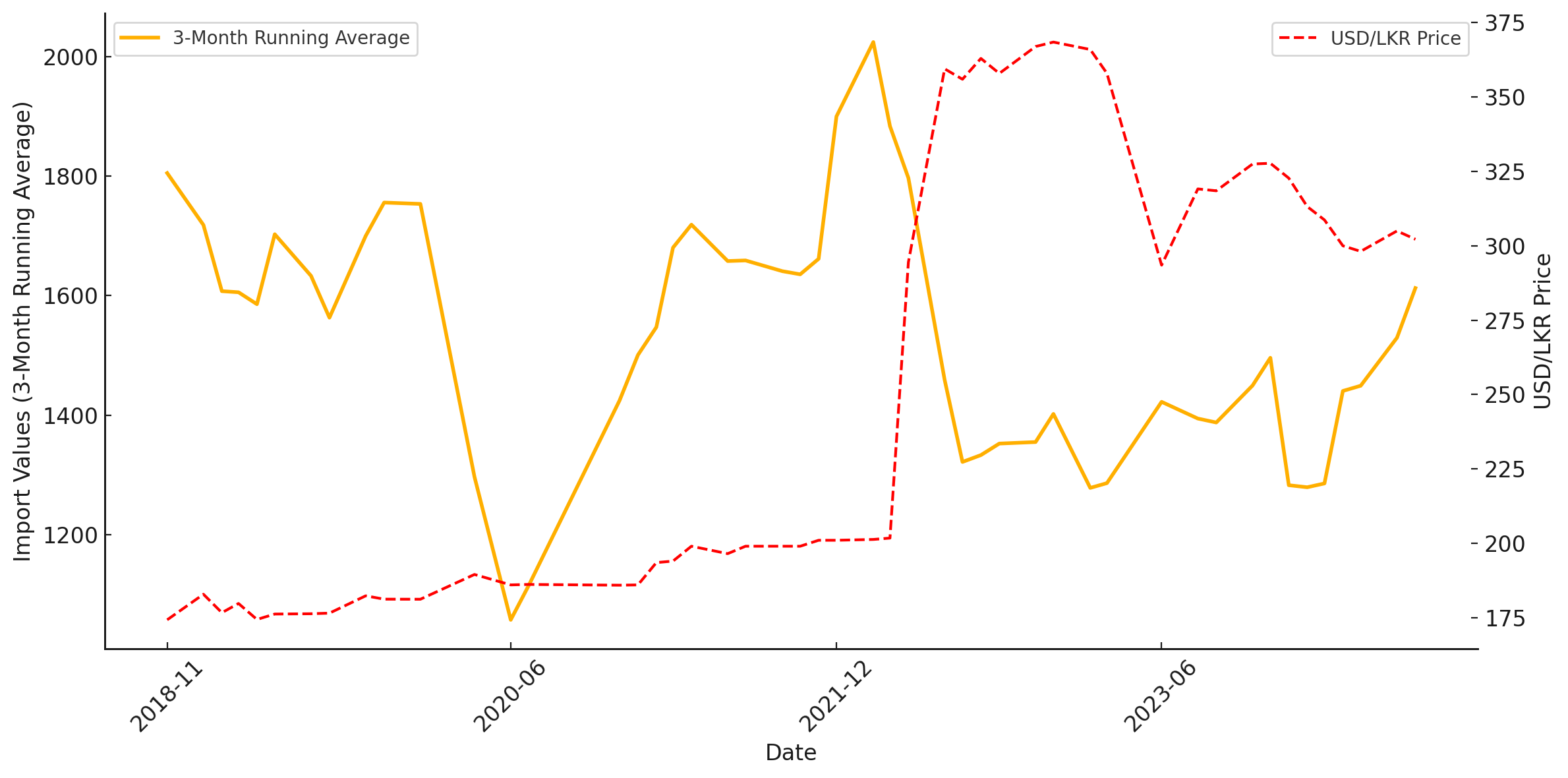

These commodities will continue to rise in USD prices while falling in RMB prices.

But the exchange rate between USD and RMB is kept relatively tight.

I do not completely understand what financial gymnastics China is doing but they could just provide Gulf countries with ‘free’ Yuan to import from China with, given their large current surpluses.

Another angle is that many coutries are facing double digit borrowing costs in USDs to rollover or service USD debts. China can stabilise these at rates almost identical to US Treasury rates , these bonds were issued at just 1 base point over UST!

This part makes sense, China can set whatever interest they want, its good to have lower interest rates but ultimately, foreign currency debt is just as dangerous, ‘poor’ countries won’t find many buyers for their domestic currency debt sure, but China can always dispense the Yuans it wants, issue debt in Yuan and have it be paid back in domestic currencies (they already do that for some countries).

Ultimately, China is still caught up in the vortex of selfishness all the other countries are (west is on a whole another level, look at their attitude towards climate financing). They don’t want to give too much for ‘free’.

This is an article I read recently on BRICS, it talks about the financing.

/cdn.vox-cdn.com/uploads/chorus_asset/file/25545430/2163086840.jpg)

Yoinked

https://imgur.com/gallery/xi-jingping-with-x-9WrD7tt